Many Filipino Social Security System members rely on its Salary Loan to help them through immediate financial needs. However, it is known that the process of acquiring this credit is oftentimes difficult and inconvenient. That’s why most Filipinos would block a whole day just to visit their SSS branch and submit their loan. Afterwards, they have to wait for about two weeks to get their checks.

This old process will soon be a memory with the state fund’s initiative to simplify and modernize the application of the SSS Salary Loan. Nowadays, you can even use your smartphone to apply for a loan, and just within three days, withdraw your cash through your UMID-ATM.

Applying a salary loan is now going to be comfortable, convenient and cost-saving for all employed SSS Members, house helpers, self-employed individuals, voluntary members, and overseas Filipino workers.

Here are the steps in applying for SSS Salary Loan Online:

1. Login to your My.SSS portal account.

– SSS requires all its members to register an account in My.SSS Portal which can be accessed in its official website, SSS mobile app, SSS branch e-centers, and self-service Express Terminals.

Aside from having exclusive access to their personal records, this facility can also be used for online submissions. Furthermore, they can easily update their member information such as landline, mobile numbers, email address and mailing address.

READ: How to Register My.SSS Account

2. Apply for Salary Online.

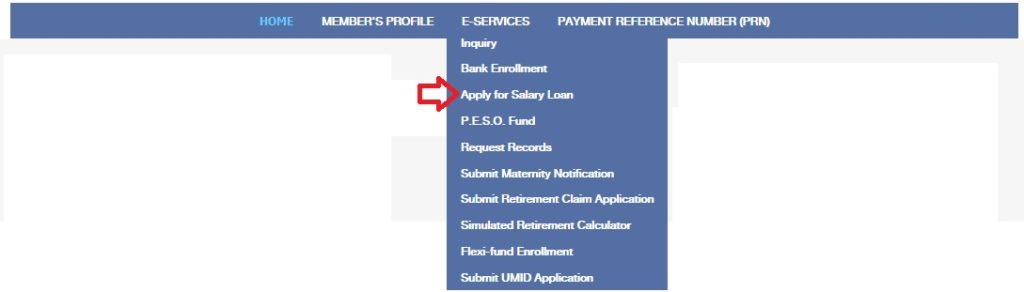

-After logging in to your My.SSS portal account, you may proceed to “Apply for Salary Loan” under the Electronic Services dropdown menu. Fill out the needed information, such as the desired loan amount, account details of UMID-ATM, or any nominated bank account. (As of this writing, only UnionBank of the Philippines (UBP) accounts are accredited for electronic loan disbursement. You can also avail the free UBP Quick Card first.)

SSS employed members’ employers will be notified for loan certification to their employers. Employers only have three working days to certify a loan application, so it is important to inform your HR about your submission.

3. Receive notification confirming loan approval.

-After your employer had successfully certified your loan, SSS will notify you in two ways; via SMS and e-mail. Thus, it is important to keep your contact information updated. You can do this easily in the My.SSS portal

4. Pay your loan proceeds using your Payment Reference Number (PRN).

– After receiving your loan, it’s time to settle the monthly loan amortization. If you are a voluntary member, you can use your PRN to pay your loan via payment channels. If you are employed, your employer will automatically deduct your loan from your salary and remit it to SSS.

READ: How to get your PRN

Take advantage of this easy process to submit your loan application and avoid the hassle of long queues and long waiting time with the My.SSS Facility.